new orleans sales tax rate

Use our sales tax calculator or download a free Louisiana sales tax rate table by zip code. The Parish sales tax rate is.

New Orleans Louisiana S Sales Tax Rate Is 9 45

All property tax bills for 2022 have been mailed and are also available online.

. The Orleans Parish Sales Tax is collected by the merchant on all qualifying sales made within Orleans Parish. The Louisiana sales tax rate is currently. Notification of Change of Sales Tax Rate for Remote Dealers and Consumer Use Tax.

The City of New Orleans sales tax rate on renting of any sleeping room will increase from 4 to 5. Table of Sales Tax Rates for Exemption for the period July 2013 June 30. Has impacted many state nexus laws and sales tax collection requirements.

The County sales tax rate is 025. This is the total of state county and city sales tax rates. Louisiana collects a 4 state sales tax rate on the purchase of all vehicles.

Homeowners will have until March 15 to submit tax bill payments before interest accrues at 1 percent per month. The definition of a hotel according to Sec. NEW ORLEANS The City of New Orleans today issued the following statement on the Quarter for the Quarter sales tax collection that was originally set to go into effect July 1 2021.

Consequently the City of New Orleans is authorized to impose the full sales tax rate effective July 1 2019. Did South Dakota v. The Orleans Parish Louisiana sales tax is 1000 consisting of 500 Louisiana state sales tax and 500 Orleans Parish local sales taxesThe local sales tax consists of a 500 county sales tax.

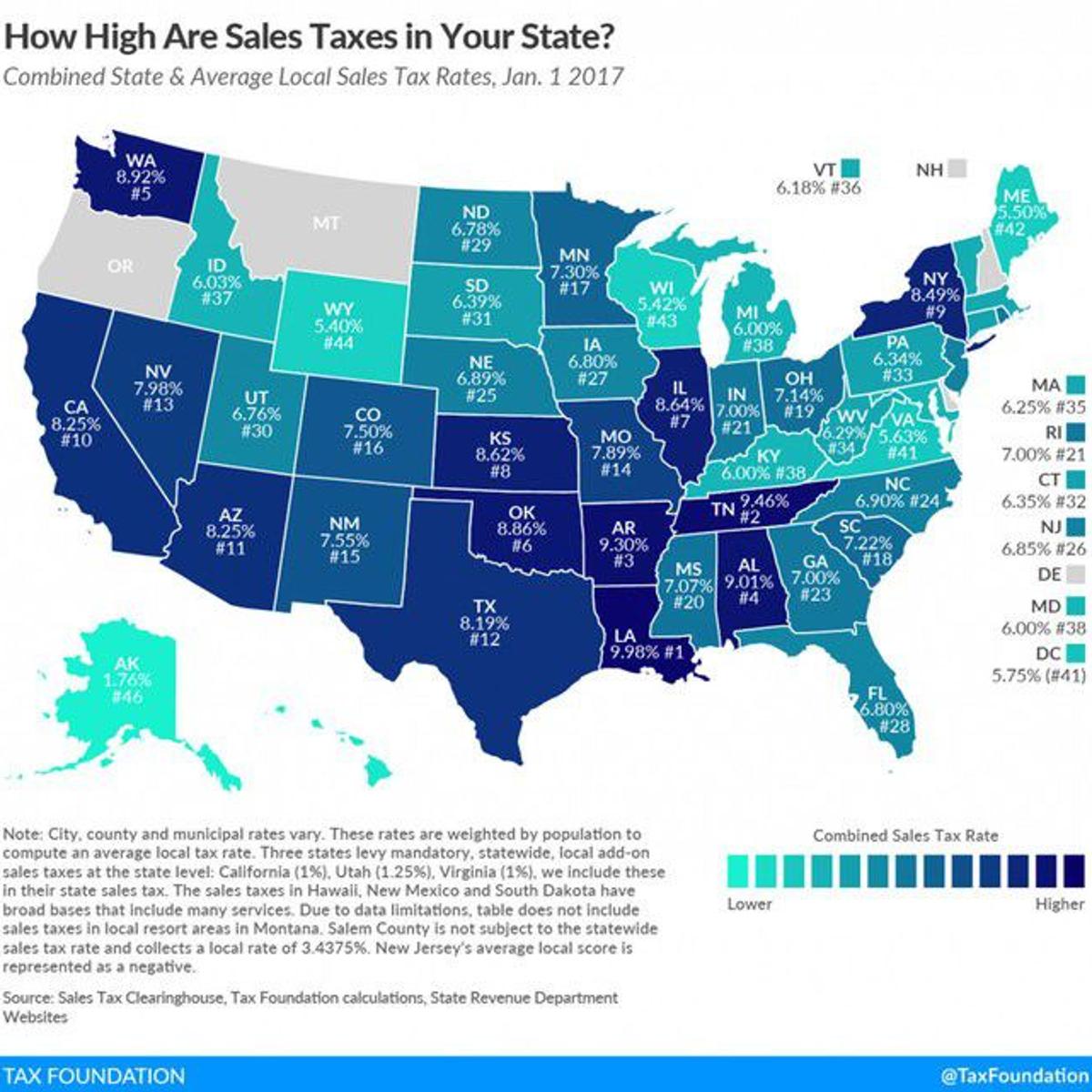

Louis Missouri 5454 percent close behind. Birmingham also has the highest local option sales tax rate among major cities at 6 percent with Denver Colorado 591 percent Baton Rouge Louisiana 550 percent and St. See R-1002 Table of Sales Tax Rates for Exemptions for more information on the sales tax rate applicable to certain items.

Louisiana has a 445 sales tax and Orleans Parish collects an additional 5 so the minimum sales tax rate in Orleans Parish is 945 not including any city or special district taxes. Orleans Parish in Louisiana has a tax rate of 10 for 2022 this includes the Louisiana Sales Tax Rate of 4 and Local Sales Tax Rates in Orleans Parish totaling 6. Louisiana has state sales tax of 445 and.

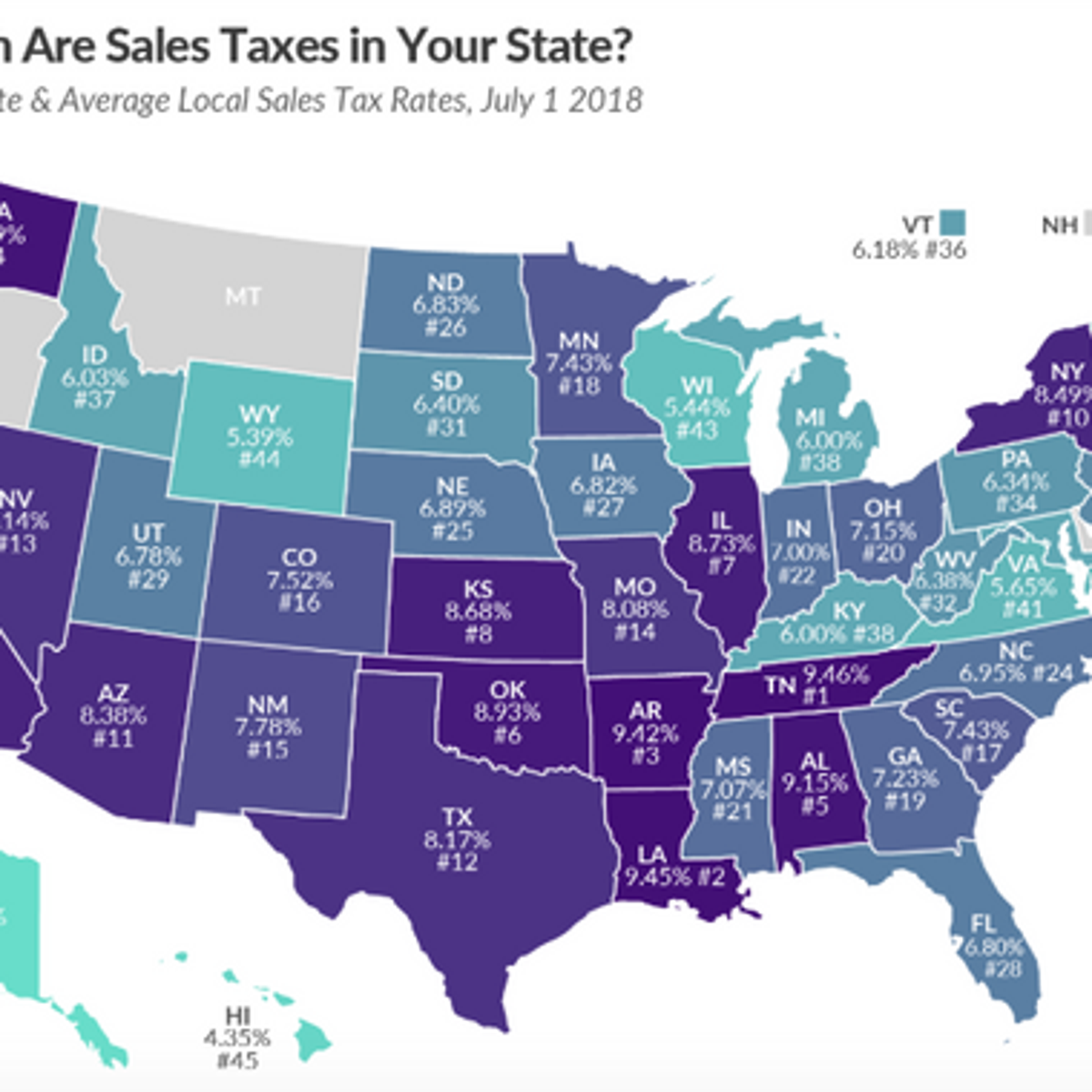

The Orleans sales tax rate is 0. Decrease in State Sales Tax Rate on Telecommunications Services and Prepaid Calling Cards Effective July 1 2018. The December 2020.

Revenue Information Bulletin 18-017. Prior to July 1 2018 the state sales tax rate was 5 for the period of April 1 2016 through June 30 2018. The minimum combined 2022 sales tax rate for Orleans California is 775.

150-874 of the City Code includes any establishment or person engaged in the business of furnishing sleeping rooms. The New Orleans sales tax rate is. 3 rows The 945 sales tax rate in New Orleans consists of 445 Louisiana state sales tax.

The California sales tax rate is currently 6. Average Sales Tax With Local. 8 rows TaxFee Description Rate Effective Date Required Filing Tax Form.

Louisiana Sales Tax on Car Purchases. Many dealerships allow you to trade-in your old car in exchange for a credit applied to the price of a new vehicle. HotelMotel Sales Tax Return and Hotel Occupancy Privilege Tax return for HotelMotelBed and Breakfast establishments.

The 2018 United States Supreme Court decision in South Dakota v. SalesUseParking Tax Return French Quarter EDD Imposed A New SalesUse Tax Rate at 0245 effective Beginning October 1 2021 Ending June 30 2026 Form 8010 Effective Starting July 1 2019 Present. But may change at any time with new tax legislation.

Rate of Tax As of July 1 2018 the state sales tax rate is 445. This table shows the total sales tax rates for all cities and towns in Orleans. Groceries are exempt from the Orleans Parish and Louisiana state sales taxes.

The City of New Orleans today reminded residents the deadline for the 2022 property tax payments has been extended to March 15 2022. There are also local taxes of up to 6. You can find more tax rates and allowances for Orleans Parish and Louisiana in the 2022 Louisiana Tax Tables.

Up to date 2022 Louisiana sales tax rates. Wayfair Inc affect Louisiana. What is the sales tax rate in Orleans California.

The total sales tax rate in any given location can be broken down into state county city and special district rates. Fast Easy Tax Solutions. The ballot measure that passed on April 24 authorized a new 0245 Quarter for the Quarter sales tax within the French Quarter that was to go into effect.

4 rows The current total local sales tax rate in New Orleans LA is 9450. Revenue Information Bulletin 18-019. Ad Find Out Sales Tax Rates For Free.

Up to date 2022 Louisiana sales tax rates. New Orleans LA Sales Tax Rate. Both Baton Rouge and New Orleans Louisiana previously had combined rates of 10 percent but these cities rates.

Calculate your total amount. For example you could trade-in your old car and receive a 5000. New Iberia LA Sales Tax Rate.

Did South Dakota v.

Which Cities And States Have The Highest Sales Tax Rates Taxjar

Sales Taxes In The United States Wikiwand

Sales Taxes In The United States Wikiwand

Louisiana Sales Tax Small Business Guide Truic

How Property Tax Rates Vary Across And Within Counties Eye On Housing

Louisiana Has The Highest Sales Tax Rate In America Business News Nola Com

Nevada Sales Tax Guide For Businesses

Pennsylvania Sales Tax Guide For Businesses

Sales Taxes In The United States Wikiwand

Bgr New Quarter Sales Tax Should Apply To Hotel Rooms Biz New Orleans

How To Calculate Sales Tax Video Lesson Transcript Study Com

Sales Taxes In The United States Wikiwand

Indiana Sales And Use Tax Audit Guide

New York Sales Tax Rates By City County 2022

Alabama Sales Tax Guide For Businesses

Louisiana Doesn T Have The Highest Sales Tax Rate In The Country Anymore Local Politics Nola Com

Missouri Sales Tax Guide For Businesses

Wyoming Alaska And S Dakota Top Tax Friendly Business State List